India has cemented its status as the world’s capital for mobile payments, leading the globe with an astounding 90.8% of its population using mobile wallets in 2023, according to a survey by GlobalData. This underscores India’s rapid advancement in embracing digital payments.

The country’s Unified Payments Interface (UPI) continues to excel, handling a staggering volume of daily transactions. In April 2024 alone, the daily transaction volume reached an impressive Rs 19.64 lakh crore, and the first half of May 2024 has already seen transactions worth Rs 10.70 lakh crore.

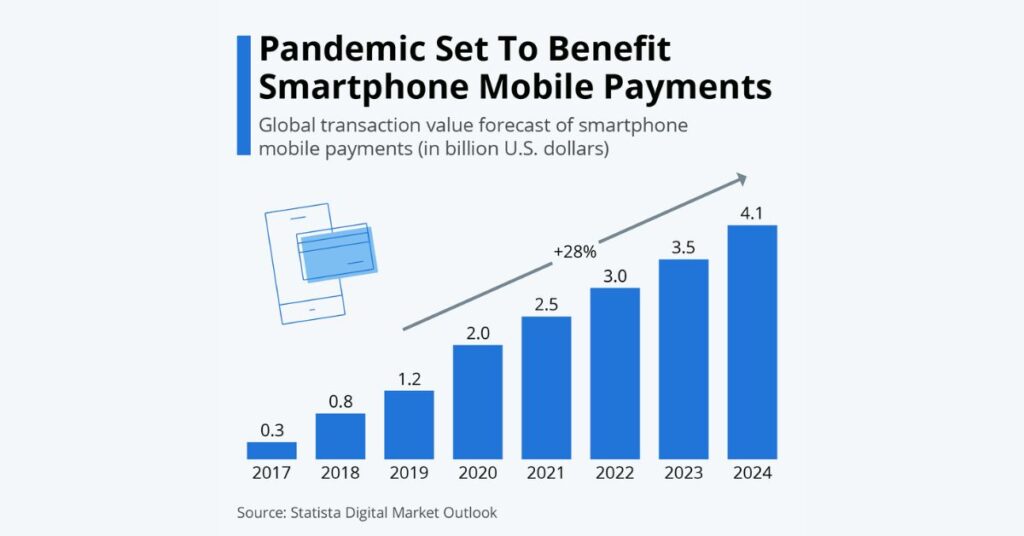

Pandemic-Driven Growth in Mobile Payments

This surge in mobile wallet usage isn’t confined to India. The Asia-Pacific region (APAC) is also experiencing a significant rise in mobile payments, a trend likely accelerated by the COVID-19 pandemic which pushed many towards contactless payment methods.

Experts anticipate that mobile wallets will have a considerable impact on other countries as well. Ravi Sharma, an analyst at GlobalData, predicts a decline in cash transactions in Hong Kong due to the increasing popularity of mobile wallets. He attributes this shift to factors such as the widespread use of QR codes, instant mobile payment systems, and a growing consumer preference for mobile payments.

Strong Foundations for Mobile Wallet Adoption

High smartphone penetration rates and a substantial number of adults with bank accounts in these regions provide a solid foundation for mobile wallet adoption. Furthermore, the availability of various domestic and international mobile wallet brands, such as Apple Pay, Google Pay, and PhonePe, offers consumers a broader choice, while increased merchant acceptance further encourages the use of mobile wallets.

This information is based on GlobalData’s 2023 Financial Services Consumer Survey, conducted in the second quarter of 2023, which included over 50,000 participants aged 18 and above from 40 countries.